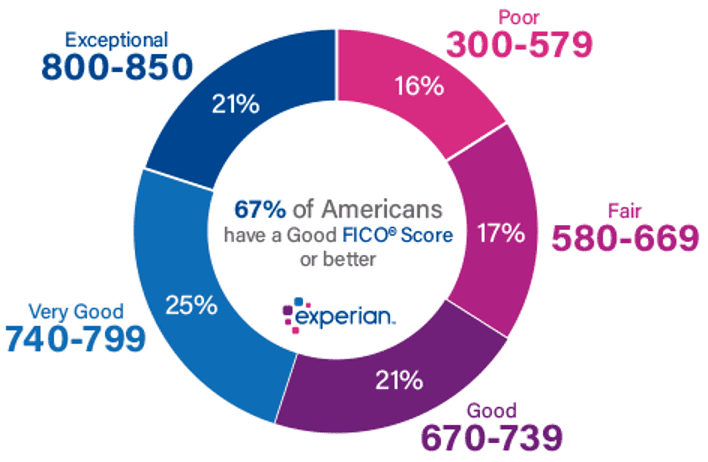

Our financial life depends heavily on our credit scores, but it can be daunting to comprehend what they signify and how to raise them. We’ll go over everything you need to know about credit scores in this piece, including what they are, how they’re determined, and how to raise your own.

What is a credit score, then? It’s a numerical depiction of your creditworthiness, to put it simply. Lenders use it to determine how risky a borrower you are before making a loan. Your risk perception decreases as your credit score rises, increasing your chances of receiving favorable conditions and credit approval.

The US’s three main credit reporting companies are Equifax, Experian, and TransUnion. Although the scoring models used by each of these agencies to determine credit scores vary slightly, they all include the same characteristics, including payment history, credit utilization, length of credit history, categories of credit, and new credit.

One of the most essential factors in determining your credit score is your payment history. It records your payment history, including any missed payments or accounts that went into collections. Paying your bills on time is critical because missed payments can significantly harm your credit score.

Another essential aspect of establishing your credit score is credit use. It is the quantity of credit you are utilizing in relation to the amount of available credit. Using a significant percentage of your available credit may signal that you rely too heavily on credit, which lenders may regard as a red flag. Your credit history’s duration is also crucial. In general, the more credit history you have, the better. It demonstrates that you have a track record of responsibly using credit over time.

Now that you know what factors influence your credit score, let’s talk about what you can do to enhance it. Paying your bills on time is one of the simplest methods to improve your credit score. Late payments can substantially negatively influence your credit score, so it’s critical to pay your obligations on time, every time.

Reduced credit card balances also benefit your credit score. Utilizing a significant percentage of your available credit may signal that you need to be more reliant on credit, which might harm your score. You can lower your credit utilization and raise your credit score by paying off your debt. In addition, verify your credit reports frequently to guarantee they are accurate. If you find any mistakes or inconsistencies, you can file a dispute with the credit reporting companies to get them fixed.

Finally, understanding credit ratings and how to improve them is an essential component of financial management. You can take charge of your credit and increase your score by paying your payments on time, minimizing your credit card balances, and reviewing your credit reports regularly.